John R. Dundon II

First Day of Tax Filing Season, the IRS Ogden (Utah) Service Center is Hobbled – IRS Crisis

Monday January 24th 2020 was NOT a good first day of tax filing season, the...

Estate Tax and Legacy Planning Considerations

Estate Tax and Legacy Planning Considerations Now that the Build Back Better (BBB) 'Framework' has...

Paycheck Protection Program (PPP) Loans Reporting – Rev. Proc. 2021-48

Forgiveness of Paycheck Protection Program (PPP) Loans Reporting - Rev. Proc 2021-48. Under IRS Rev....

Eight Issues to Watch for as You Prepare to Have Your 2021 Income Tax Returns Filed

As 2021 comes to a close, eight issues to watch for as you prepare to...

Are Certain Foster Care Payments Taxable? Medicaid Waivers and IRC 131

Are Certain Foster Care Payments Taxable? Medicaid Waivers and IRC 131 The intent of this...

Partnerships and Income Tax – Staring into the Abyss of IRS Form 1065

Partnerships and Income Tax - Staring into the Abyss of IRS Form 1065 and its...

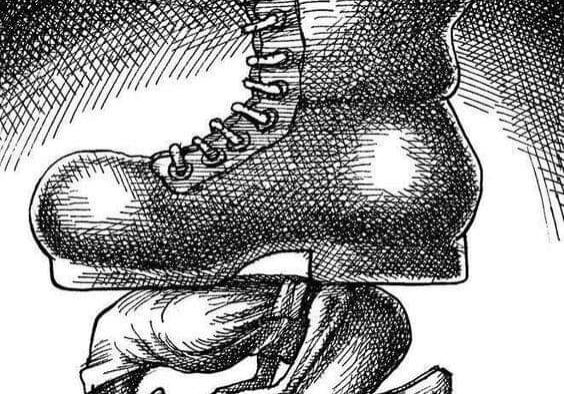

IRS Commissioner calls CRISIS!

IRS Commissioner calls CRISIS! Rettig's editorial in the Washington Post as released by the US...

- « Previous

- 1

- 2

- 3

- Next »