Improving IRS Communication Efforts

Harrison Smith and Justin Abold-LaBreche are improving IRS communication efforts. As Co-Directors of the IRS Enterprise Digitalization and Case Management Office with experience across multiple IRS offices, they spearhead efforts to modernize systems, simplify business processes, and empower employees to rapidly resolve issues in simplified digital environments.

The Enterprise Digitalization & Case Management Office, created in July 2020, addresses the need to modernize and consolidate many OLD systems, business processes and policies. They rise to the challenge of implementing digitalization and case management initiatives and improve the experience of IRS employees and taxpayers alike with the resources that congress has allocated.

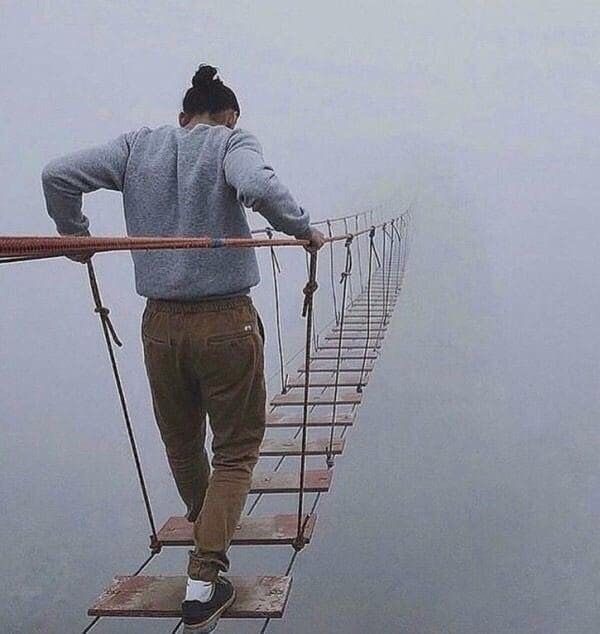

Take a Closer Look at how they approach their challenges here. From my perspective it is a bit like negotiating a rickety rope bridge into an unseen abys but is MUCH better than the alternative nightmare many are presently experiencing.

Combined with these efforts in another Closer Look article the Small Business/Self-Employed Division (SB/SE) introduces a Taxpayer Digital Communication initiative. This is basically several digital channels used to communicate with each other including:

- Secure Messaging

- Text Chat

- Outbound Notifications.

Secure Messaging

Secure messaging allows the IRS and the taxpayer to share messages and supporting documents through a secure portal. Here are some #BuzzworthyFacts.

- It is used in the SB/SE Division’s Correspondence Examination operations, Large Business & International (LB&I) Division and Appeals Division.

- It is also used, on a smaller scale, in SB/SE’s office audit and Automated Under reporter (AUR) programs.

- The AUR program matches information returns (Forms 1099, W-2s, etc.) against data reported on individual tax returns, and may also generate proposed assessments.

- SB/SE is presently looking at other areas where this feature can be used, including in its Field Collection and Field Examination organizations.

- Secure Messaging allows IRS assistors to upload large files up to 1GB in size.

- To date, over 21,000 taxpayers have signed up to take advantage of this service.

Text Chat

Text Chat provides real-time chat assistance and enables assistors to exchange text messages, files, webpages, and other information to address taxpayer queries. There are several chat applications.

- Automated Collection System (ACS) Chat involves resolving Collection notices.

- Letter 5972C, Automated Collection System Text Chat, encourages taxpayers to resolve notice issues by using the available self-help and online resources.

- The IRS has also added a “chat button” to the payments page & certain Online Payment Agreement (OPA) error pages to help resolve rejected agreements, to Letter 16.

- There is a proactive chat on the “Additional Instructions on Payment Plans” webpage.

- Proactive chat is a pop-up Text Chat bot that displays when a taxpayer has been on a webpage for 30 seconds, but only if there is a live assistor available.

- Authenticated chat handles OPA questions including the ability for taxpayers to upload attachments.

- It also features Spanish language support.

Outbound Notifications

Taxpayer Digital Communication-Outbound Notification (TDC-ON) is a web-based application that gives individual taxpayers access to specific IRS notifications through the Online Account (OLA) application.

- Register for an Online Account to be able to access notifications, as well as view account balances and make payments.

For more on how to more efficiently communicate with the IRS contact me.